Do Teslas Qualify For Tax Credit In 2024

Do Teslas Qualify For Tax Credit In 2024. More evs are expected to become eligible as automakers start to. Some vehicles that don't qualify for the full $7,500 still qualify for a partial credit.

Despite the list of qualifying evs getting shorter, the 2024 guidance also lets sellers offer the rebate at the point of sale, rather than buyers being forced to wait until. A nationwide search of used teslas on our sister site, autotrader, shows more than 7,400 for sale in the u.s.

That Means Some Cars That Currently Qualify For The Credit Won’t Be Eligible Starting January 1, Complicating Things For Consumers Trying To Get Into An Ev Cheaply.

Some ev battery rules loosen, potentially making more cars eligible for tax credits the credits range from $3,750 to $7,500 for new evs.

Also, On The Buyer’s Side, The Income Limits Still Apply To Be Eligible To The Tax Credit:

More evs are expected to become eligible as automakers start to.

This Will Be More Stringent In 2025, Saying Evs Should Not Contain Any Critical Minerals That Were Extracted, Processed, Or Recycled By An Feoc To Qualify.

Images References :

Source: vnexplorer.net

Source: vnexplorer.net

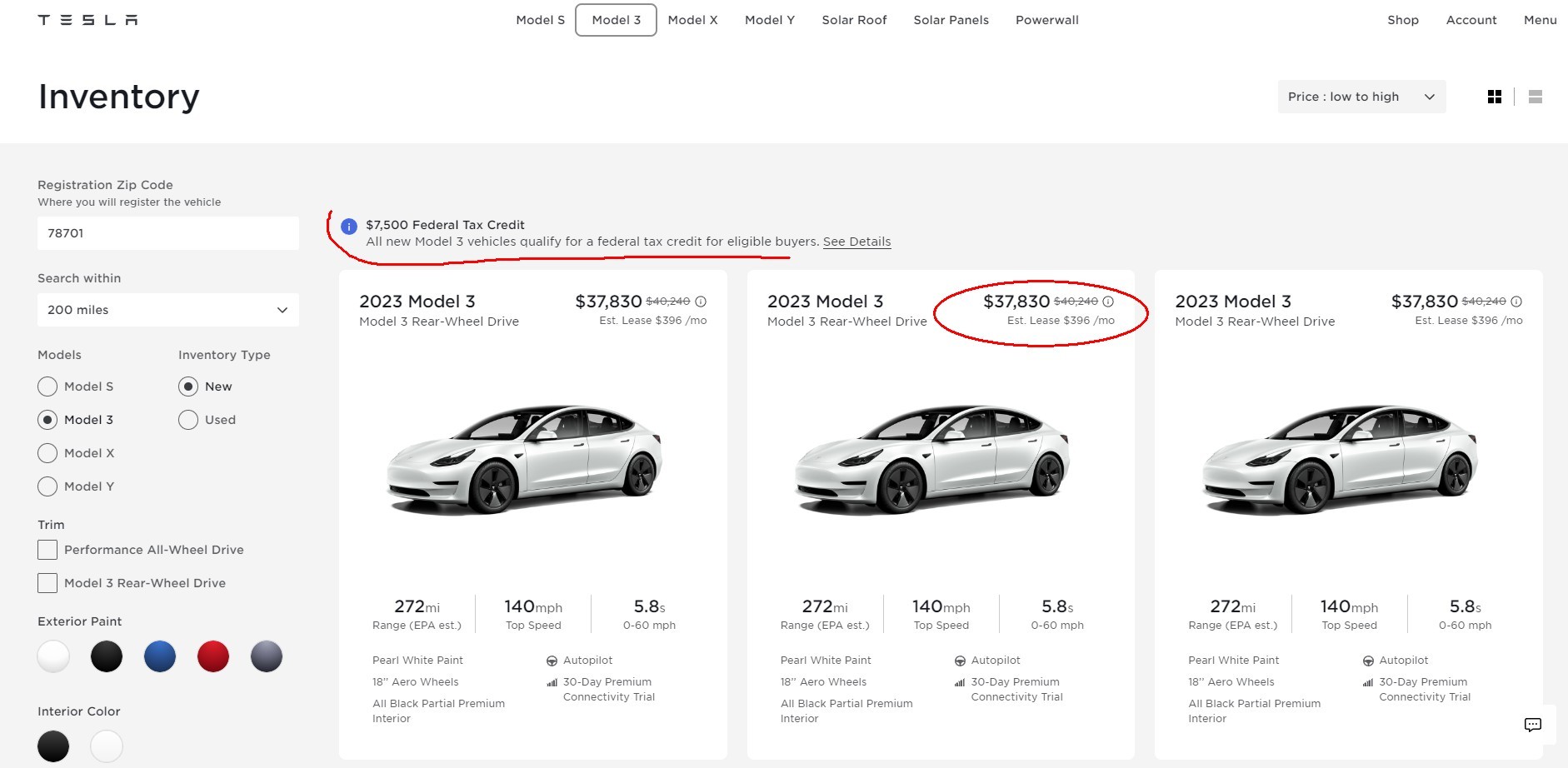

Tesla says all new Model 3s now qualify for full 7,500 tax credit, Despite the tax credits, sales of electric vehicles. Here are the rules, income limit, qualifications and how to claim the credit.

Source: www.cbsnews.com

Source: www.cbsnews.com

Tesla Model Y and other electric vehicles will now qualify for 7,500, Currently, only 22 out of the 104 electric vehicles for sale in the us are eligible to the tax credit. Six of the top 10 battery manufacturing companies are based in china, the country that dominates cathode, anode and refined battery materials production.

Source: www.youtube.com

Source: www.youtube.com

NEW Tesla Tax Credits They Changed Everything YouTube, Nissan leaf models manufactured in 2024 and sold on or after march 6, 2024 may qualify for a partial tax credit photo: Despite the tax credits, sales of electric vehicles.

Source: www.youtube.com

Source: www.youtube.com

TESLA EV TAX CREDIT EXPLAINED YouTube, Here are the rules, income limit, qualifications and how to claim the credit. Currently, only 22 out of the 104 electric vehicles for sale in the us are eligible to the tax credit.

Source: balleralert.com

Source: balleralert.com

Tesla Reduces Price Of Model S by 30,000 and Model X by 41,000 to, That means some cars that currently qualify for the credit won’t be eligible starting january 1, complicating things for consumers trying to get into an ev cheaply. The internal revenue service released its list of electric vehicles that will still qualify.

Source: www.youtube.com

Source: www.youtube.com

Tesla Tax Credits Are BACK Up To 40,000 YouTube, Of 114 ev models currently sold in the u.s., only 13 qualify for the full $7,500 credit, the automotive alliance said. That means some cars that currently qualify for the credit won’t be eligible starting january 1, complicating things for consumers trying to get into an ev cheaply.

Source: insideevs.com

Source: insideevs.com

US All Tesla Model 3 Versions Qualify For 7,500 Federal Tax Credit Now, $150,000 for a household, $75,000 for a single person. That means some cars that currently qualify for the credit won’t be eligible starting january 1, complicating things for consumers trying to get into an ev cheaply.

Source: www.autoevolution.com

Source: www.autoevolution.com

How Tesla Bent IRA Rules To Get Full 7,500 Tax Credit for Model 3 RWD, Photo by andrew hawkins / the verge. Second, buyers no longer have to have a tax liability equal to or greater than the amount of the credit — a rule that previously kept a lot of buyers from accessing the.

Source: www.ourmidland.com

Source: www.ourmidland.com

All Tesla Model 3, Y Variants Eligible For Full EV Tax Credit, Fewer electric car models qualify for tax credits in 2024 after new requirements kicked in on jan. New inflation reduction act provision broadens access and boosts return on clean energy tax creditswashington, d.c.

Source: www.youtube.com

Source: www.youtube.com

EV Tax Credit Update November 2021 (Tesla Tax Credits!!!) YouTube, On january 1, 2023, the inflation reduction act of 2022 qualified certain electric vehicles (evs) for a tax credit of up to $7,500 for eligible buyers. Of 114 ev models currently sold in the u.s., only 13 qualify for the full $7,500 credit, the automotive alliance said.

Of 114 Ev Models Currently Sold In The U.s., Only 13 Qualify For The Full $7,500 Credit, The Automotive Alliance Said.

Currently, only 22 out of the 104 electric vehicles for sale in the us are eligible to the tax credit.

The Irs Has Now Released Its Full List Of Electric Vehicle Models Eligible For The New And Updated $7,500 Us Federal Tax Credit.

The tax credit rules get a lot stricter in 2024.